Microfinance serves as an effective tool for poverty alleviation and economic empowerment by granting access to financial services like credit and insurance. Ahilya Gramin plays a pivotal role in providing these services to the unserved and underserved population, enabling them to initiate or expand small businesses and elevate their incomes.

The organization extends both financial and non-financial services to resource-poor, unbanked, and marginalized individuals in rural and semi-urban areas. These services are tailored to meet the evolving needs of communities engaged in agricultural and small business activities. Employing the group lending model (SHG and JLG), wherein poor women mutually guarantee each other’s loans, the organization ensures a robust support system. Borrowers undergo financial literacy training and must pass a test before accessing loans. Monthly meetings with borrowers follow a highly disciplined approach. The repayment rates on the company’s collateral-free loans exceed 99% due to diligent monitoring and follow-up on loan utilization. Additionally, Ahilya Gramin has systematically introduced various individual need-based products for its clients.

In line with its commitment to serving a broader segment, the company has introduced large-size individual loans to provide financial assistance to the MSME sector. It has also launched individual loans for housing finance, catering to the affordable housing segment.

Group loans

Providing loans to rural households, especially women, to expand their existing businesses or venture into new livelihood activities, thereby diversifying their income sources. These loans could be utilized in agricultural endeavours, establishing and nurturing microbusinesses, supporting handicraft and handloom industries, among others.

Ahilya Gramin empowers thousand women customers and aims to create a deeper impact in society by strengthening the rural women population of the country.

Tenure

12 – 24 Months

Repayment Frequency

(Weekly – Biweekly-Monthly)

Attractive

Interest Rates

You can avail a loan at lower interest rates with us.

Note: Interest rates are calculated on a reducing balance basis per annum.

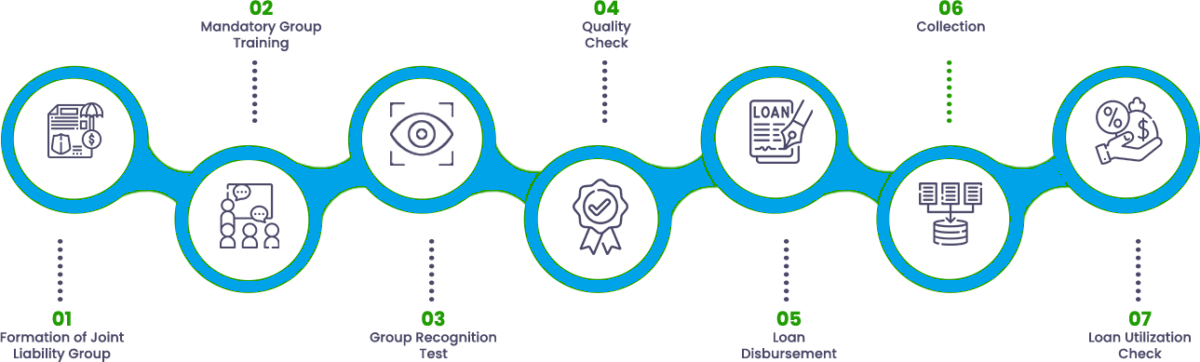

Our Process

Client Selection & Approach for gradation of risk:

The decision to give a loan is assessed on a case to case basis, based on multiple parameters such as borrower profile and repayment capacity, borrower’s other financial commitments, past repayment track record if any, tenure of the loan, occupation and stability of income, geography (location) of the borrower, end-use of the loan, etc. Such information is collected based on borrower inputs and field inspection by the company officials.

Women Empowerment

As a microfinance organization, Ahilya Gramin primary aim is to empower women from rural backgrounds and provide them the financial support needed to start business ventures and contribute to the economy. Ahilya Gramin empowers thousand of women customers and aims to create a deeper impact in society by strengthening the rural women population of the country.

Retail loans

We extend our support to micro, small, and medium enterprises, addressing their crucial working capital requirements. Our product is strategically crafted to offer seamless financing solutions to both registered and unregistered business segments. These loans are determined by the client’s profile, often influencing the loan amount. The loan supports upgrading existing business infrastructure, restocking inventory, and expanding operational capacities, among other business-enhancing endeavours.

Tenure

06 – 24 Months

Repayment Frequency

(Weekly – Biweekly-Monthly)

Attractive

Interest Rates

You can avail a loan at lower interest rates with us.

Note: Interest rates are calculated on a reducing balance basis per annum.